All You Need to Know About Pocket Option Fees

To truly understand how Pocket Option Fees can impact your trading activities, it’s vital to delve into the specifics of what these fees entail. Pocket Option, like most trading platforms, implements a series of fees that contribute to its functioning and sustainability. Aspiring traders and seasoned investors alike must recognize these fees to manage their portfolios efficiently and accurately.

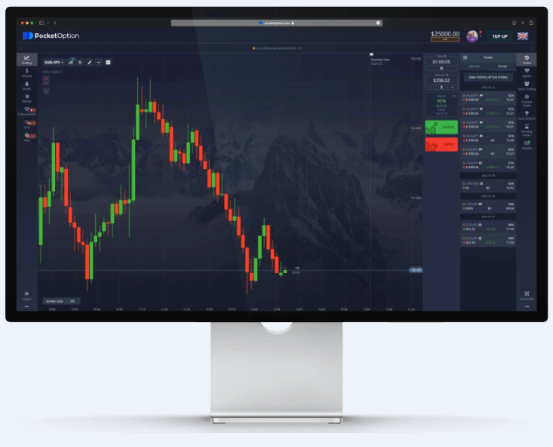

Introduction to Pocket Option

Pocket Option first emerged in the trading landscape with a mission to create an exceptional trading experience for its users. By offering an easy-to-use interface and a broad range of trading options, the platform quickly gained a foothold in the competitive world of online trading. However, understanding the fee structure is crucial for anyone looking to maximize their potential returns on the platform.

Understanding the Core Fee Structure

The Pocket Option fee structure is relatively straightforward compared to other trading platforms. Typically, these fees are segmented into several key categories designed to cover different parts of trading on the platform. Here is a breakdown of the primary fee types you may encounter while using Pocket Option:

1. Trading Fees

When you place a trade on Pocket Option, you can often expect to encounter trading fees, though they can vary depending on factors like account type and trade volume. Trading fees are vital for the establishment as they contribute significantly to maintaining the platform’s services.

An important aspect to note is the variation in trading fees for different trading types, such as digital options, forex, and binary options. Potential investors should thoroughly research the fees applicable to the specific trading type they wish to engage in.

2. Commission Fees

Besides trading fees, Pocket Option may charge commission fees on certain trades. This fee usually depends on the asset class and the specific contract involved. Typically, more complex or higher-risk trades may involve higher commission fees. Therefore, performing due diligence before engaging in such trades is paramount.

3. Deposit and Withdrawal Fees

Pocket Option offers a range of payment methods for deposits and withdrawals, which sometimes involve fees. These fees can either be a percentage of the total transaction amount or a fixed rate. While some methods, like certain e-wallets, might offer free transactions, others, such as bank transfers, might incur additional charges.

Additionally, it’s worth noting that the processing time for these transactions can vary significantly based on the method selected. It’s always advisable to fully understand these fees and timelines to avoid any unpleasant surprises.

4. Inactivity Fees

Like many other trading platforms, Pocket Option can impose inactivity fees on accounts that have remained dormant for an extended period. These fees are meant to encourage active trading on the platform. If you don’t use your account frequently, you may incur charges, which can diminish your account balance over time. Traders can often avoid these fees simply by placing trades or conducting any minor transactions periodically.

Strategies to Minimize Fees

Although fees are an inevitable aspect of trading on platforms like Pocket Option, traders can adopt several strategies to minimize their impact. Below are a few tips to keep your fees as low as possible:

1. Choose the Right Account Type

Pocket Option offers multiple account types, each with different fee structures and benefits. By selecting an account type that aligns with your trading habits and objectives, you can significantly minimize the fees you incur over time. Account features often differ based on deposit amounts, offering benefits like reduced fees for higher-tier account holders.

2. Stay Informed about Promotions and Discounts

Periodically, Pocket Option might offer promotions or discounts on their fees, particularly to new traders or during special events. It’s worth keeping an eye on these opportunities as they can offer significant savings. Regularly checking the Pocket Option website or subscribing to their newsletter will ensure you don’t miss out on these offers.

3. Utilize Free Payment Methods

If available, always opt for payment methods that incur no fees. This decision might seem minor initially, but avoiding small transaction fees can lead to substantial savings over the long term. Make sure to research all available payment options and choose the most cost-effective one that aligns with your financial situation.

4. Maintain an Active Trading Account

The simplest way to avoid inactivity fees is by keeping your account active. Whether this means making small trades regularly or simply logging into your account periodically, maintaining an active presence on the platform can save you from unnecessary charges.

Conclusion

Understanding Pocket Option Fees is crucial for anyone serious about trading on the platform. While some fees are unavoidable, strategic planning can help minimize their impact on your overall trading success. By staying informed and proactive about fee structures, investors can considerably optimize their trading activities, ensuring that more of their profits remain their own.

In summary, while the Pocket Option platform provides a user-friendly and innovative trading experience, getting to grips with its fee structure is essential for maximizing financial efficiency and success. Always be sure to read the fine print, conduct thorough research, and engage in discussions with customer support if you need further clarifications on any fees applicable to your trades.